BREAK INTO HIGH FINANCE

No Club Required

A step-by-step course to help students from liberal arts and non-target backgrounds stand out and succeed in the fast-paced finance recruiting cycle.

ACE INTERVIEWS

✓

DEVELOP YOUR "WHY FINANCE" STORY

✓

UNDERSTAND CAREER PATHS

✓

MASTER BEHAVIORALE & TECHNICAL QUESTIONS

✓

ONLINE AND ON CAMPUS

✓

ACE INTERVIEWS ✓ DEVELOP YOUR "WHY FINANCE" STORY ✓ UNDERSTAND CAREER PATHS ✓ MASTER BEHAVIORALE & TECHNICAL QUESTIONS ✓ ONLINE AND ON CAMPUS ✓

BUILT FOR STUDENTS

Without a Built-In Network

Adventis's new program—developed with career experts and a 30-year finance industry veteran—gives students who didn't attend a target school or join a selective club the edge they need to stand out.

Whether you're an individual student preparing independently or a faculty member looking to level the playing field across your campus, this program offers the structure, support, and skills to compete for roles in investment banking, private equity, and other top finance positions.

-

Finance Exploration

Understand career paths, develop your "Why Finance" story

-

FMC® Program

Complete the Financial Modeling Certification® to build technical skills

-

Technical Finance

Learn valuation, accounting, and deal analysis

-

Interview Prep

Master behavioral and technical questions to ace interviews

Choose Your Track

-

For Students: You Don't Need a Club to Land the Job

This track is built for students who are exploring finance careers on their own or outside traditional finance clubs, or getting ahead of the recruitment process. You'll get a proven framework, the FMC® Program, and a full interview prep toolkit—all designed to help you break in.

-

For Schools: Scalable Finance Interview Prep for Your Campus

Implement a proven recruiting curriculum for liberal arts and non-business majors. Whether you're a career services professional or faculty member, you'll gain a structured, high-impact solution designed to improve outcomes for students interested in finance careers.

FROM LIBERAL ARTS

to Wall Street

This program draws from the proven strategy used at Amherst College, built by a seasoned finance leader and career coach. Students completing this curriculum have gone on to secure roles at top firms including Morgan Stanley, Citi, and JPMorgan.

“When I started, alumni and recruiters said Amherst students couldn’t answer basic technical questions, which resulted in fewer successful candidates. Now they are now excelling in the interview process.”

Built Around Your Semester

This course is modular and designed to be your "fifth class"—a consistent, manageable commitment across the fall or spring semester.

Sample Schedule:

Week 1: Kickoff + FMC® Program

Weeks 2–4: Industry Exploration

Weeks 5–8: Technical Finance

Weeks 9–12: Interview Prep + Mock Interviews

LEARNING

Objectives

✓

✓

✓

Part 1: Exploration

Introduction to the finance industry

Deep dive into Investment banking

Creating your personal brand, finance-focused elevator pitch, resume and networking

Part 2: Financial Modeling Preparation

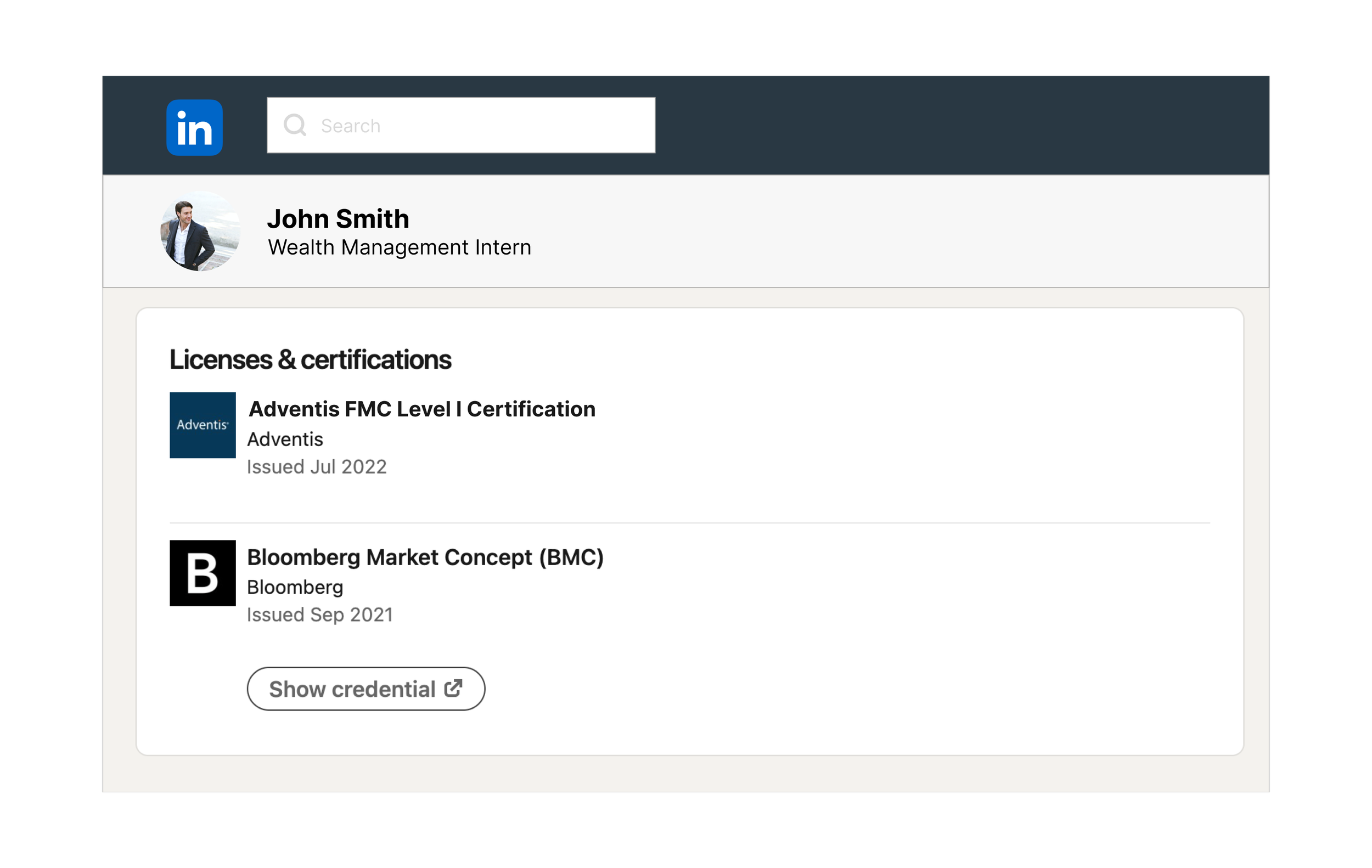

Students complete the asynchronous Adventis Financial Modeling Certification (FMC®) program and pass the level 1 certification exam

✓

✓

✓

Part 3: Technical Finance Preparation

Accounting overview

Equity Value vs. Enterprise Value

DCF and Valuation

Following a deal or company

✓

✓

✓

Part 4: Interview Prep

How to answer fit/behavior questions

How to answer technical finance questions

✓

✓

✓

Ready to Prepare?

GET STARTED

Whether you're an individual student ready to invest in your future, or an educator ready to make an impact across your campus—we're here to help.

Questions

FREQUENTLY ASKED

-

The FMC® Program consists of approximately 8 hours of asynchronous videos and course materials in the Adventis portal. These are available for two years after enrollment. The videos are designed for candidates to learn financial modeling from scratch and enable enrollees to complete the FMC® Program at their own pace. Enrollees also get free access to our online exams and can take as many exams as they’d like in order to earn our certifications.

-

By earning our certifications, enrollees develop the skills required to efficiently build properly formatted three-statement financial models from scratch and be proficient in valuation and leveraged buyout concepts. Because getting certified requires candidates to practice building out our financial models from scratch many times, those seeking certification are forced to learn by doing, which greatly enhances retention as well as a technical understanding of financial and accounting principals.

Many enrollees take our program to prepare for internship and full-time interviews for investment banking, private equity, and other competitive fields in finance. Our certification process is highly aligned with their technical interview prep, as it helps them to internalize, rather than memorize, key concepts that are asked in interviews. The certification also provides them with strong talking points, as the certification process enables them to tell stories that demonstrate their financial acumen, work ethic, attention to detail, and resilience.

Additionally, our certifications give enrollees a strong skill set that greatly enhances their on-the-job performance in class projects, case study competitions, internships, and full-time positions.

-

The FMC® Program is meant for individuals from a wide range of backgrounds. Participants with a liberal arts background that have little to no accounting or finance experience can get a lot out of the FMC® Program. We take participants through each step of building out financial models so they will learn finance and accounting concepts as they progress through the program and without having to do any extra research on their own. Alternatively, if participants have a strong finance and accounting background, they can also get a lot out of the FMC® Program, as we teach them how to build best-of-class financial models quickly and efficiently.

-

The FMC® Program is most valuable for roles in investment banking, private equity, equity research, and related industries. However, it is also valuable for corporate finance, corporate development, transaction services, valuation services, and a slew of other industries. And it’s also valuable for general roles in business that typically requires work to be done in Microsoft Excel, but doesn’t require financial modeling work, such as accounting, consulting, and treasury.

-

Many undergraduate students choose to take the FMC Program while they are 1st and 2nd year students in order to properly prepare for the rigorous recruiting cycles for investment banking, private equity, and other competitive fields in finance. However, we also have many 3rd and 4th year students enroll in the program to prepare for internship and full-time recruiting and brush up on their financial modeling skills. Know that there is no single right time to enroll. Candidates come to us during various stages in their undergraduate careers with the shared goal of preparing for recruiting, building financial modeling skills, and gaining a technical understanding of financial concepts.

-

Many professionals take the FMC Program early in their careers in order to facilitate their transition into roles in investment banking, private equity, and other competitive fields in finance. Some earn our certifications in advance of lateral recruiting in order to stand out from the crowd, whereas others take Adventis as on-the-job training.

However, many other professionals also take Adventis because they simply want to add strong financial modeling skills to their toolset and build their abilities in their current roles in corporate finance, asset management, and a number of other fields.